operating cash flow ratio adalah

Operating cash flow ratio is generally calculated using the following formula. 872 975.

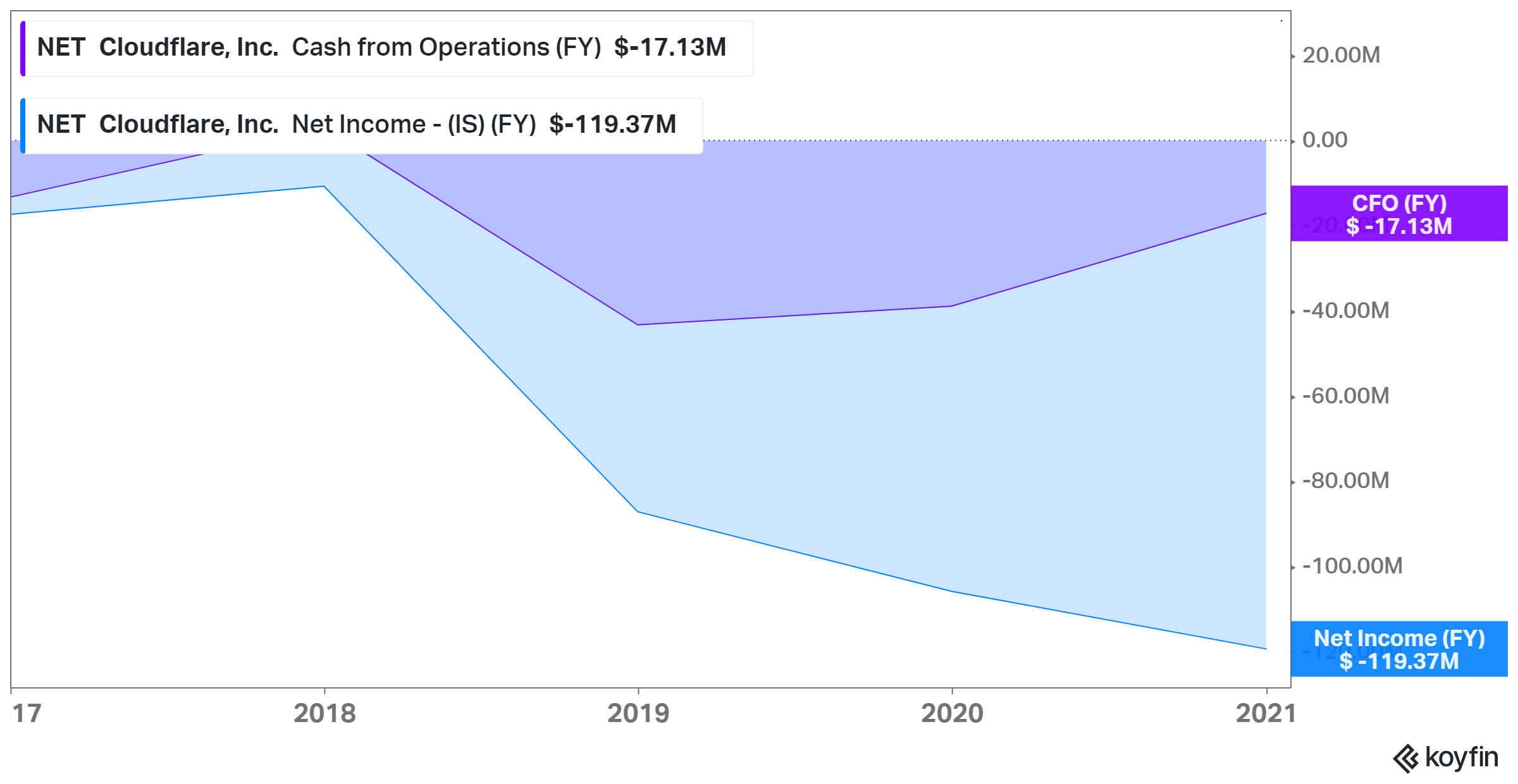

What Does A Negative Operating Cash Flow Mean Cliffcore

Operating Cash Flow.

. An operating cash flow margin is a measure of the money a company generates from its core operations per dollar of sales. For example a company with 700 million in operating cash flow and net sales revenue of 28 billion would have an operating cash flow to sales ratio of 25. Cash ratio atau dalam bahasa Indonesianya adalah rasio kas adalah rasio yang bisa digunakan untuk menilai perbangan antara total kas dan setara kas.

Arus Kas dari Operasi berasal dari Laporan Arus Kas dan Kewajiban Lancar. Operating Cash Flow Margin. Laporan arus kas adalah komponen dari laporan keuangan yang memuat informasi mengenai aliran keluar masuknya kas dan setara kas.

We can apply the values to our variables and calculate Cash Flow to Sales. OCR Ratio Cash flow from operating activities Current liabilities. Its cash flow from operations in the past year was 350000.

Operating cash flow represents the cash a company generates from normal business operations. Every 1 that it earns in sales. Arus kas dari operasi atau Cash flow from operating activities merupakan bagian dari arus kas perusahaan yang mewakili.

Operating Cash Flow Ratio Arus Kas Dari Operasi Kewajiban Lancar. It includes cash inflows and outflows related to a companys main. The Operating Cash to Debt ratio is calculated by dividing a companys cash flow from operations by its total debt.

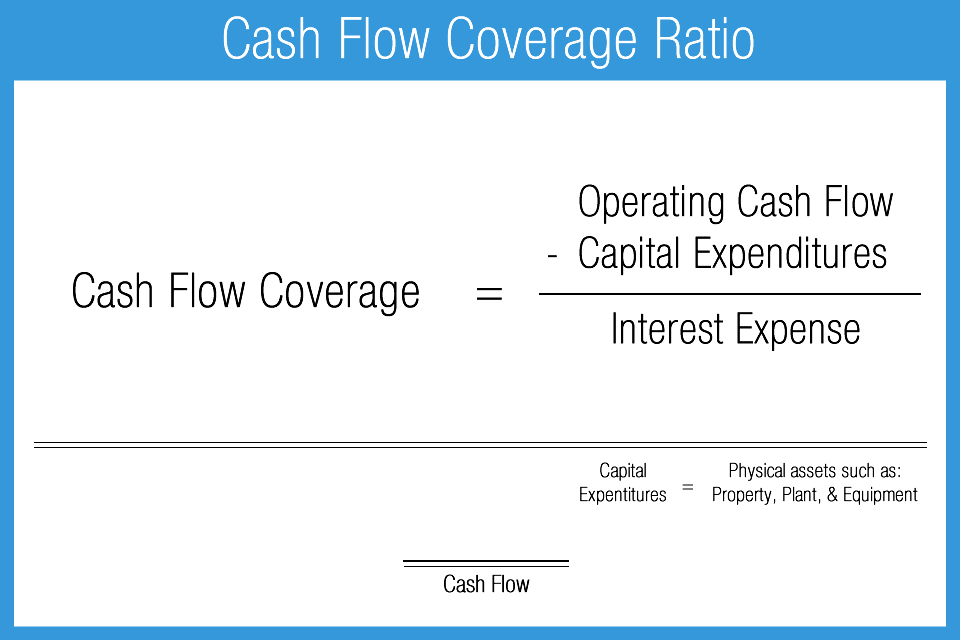

The formula for calculating the operating cash flow ratio is as follows. The companys cash flow to debt ratio would be calculated as follows. Rumus OCFR adalah.

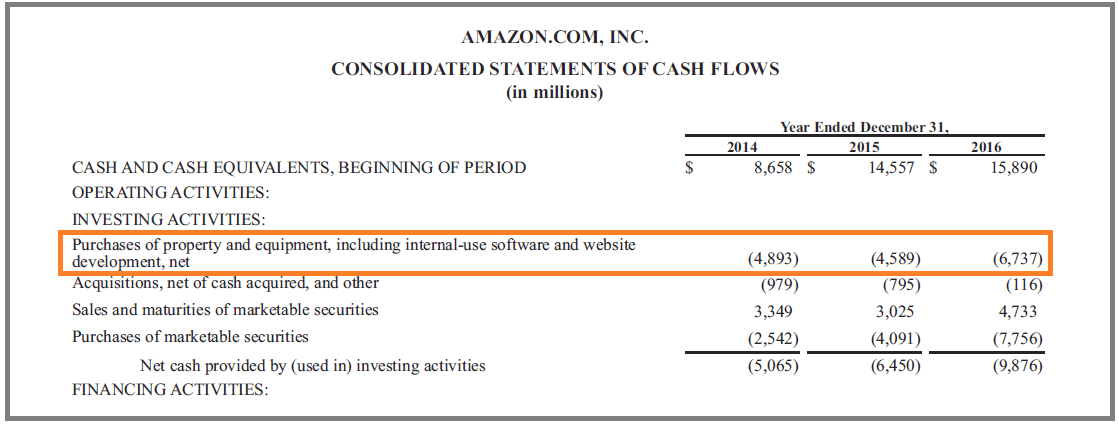

Bagaimana Cara Menghitung Rasio Arus Kas. Arus kas dari operasi kewajiban operating cash flow ratio. In 2017 free cash flow is calculated as 18343 million minus 11955 million which equals.

350000 1500000 023 or 23. The formula to calculate the ratio is as follows. Operating cash flow ratio is an important measure of a companys liquidity ie.

Apa itu Laporan Cash Flow. The FCF formula is Free Cash Flow Operating Cash Flow Capital Expenditures. It is expressed as.

When performing financial analysis operating cash flow should be used in conjunction with net income free cash flow FCF and other metrics to properly assess a. Definisi Arus Kas dari Operasi Cash Flow from Operating Acivities. Pengertian Cash Ratio.

Since the ratio is lower than 1 it indicates that Bower Technologies has a weak financial standing or is. Now lets use our formula. Cash flow from operations can be found on a companys statement of cash flows.

Ada beberapa cara untuk menghitung rasio arus kas.

Operating Cash Flow Ratio Calculator

What Is A Common Size Cash Flow Statement 365 Financial Analyst

Capital Expenditure Capex Guide Examples Of Capital Investment

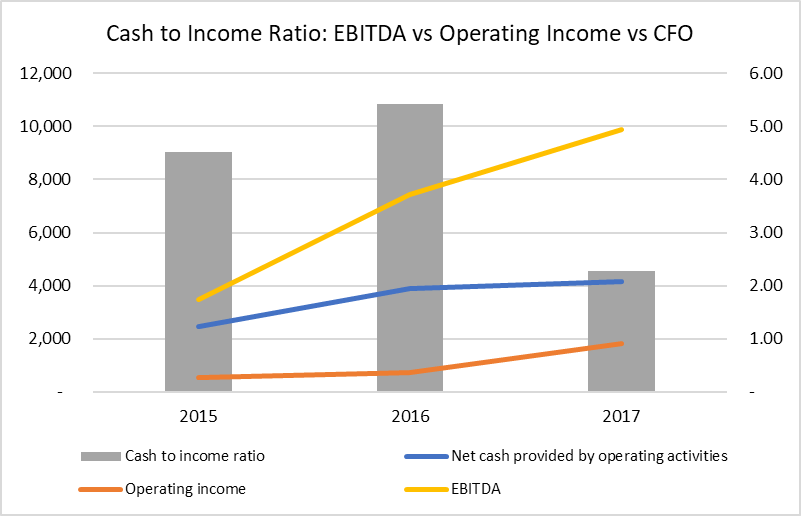

Cash To Income Ratio Formula And Example

Cash Flow Adequacy Ratio Formula And Calculation

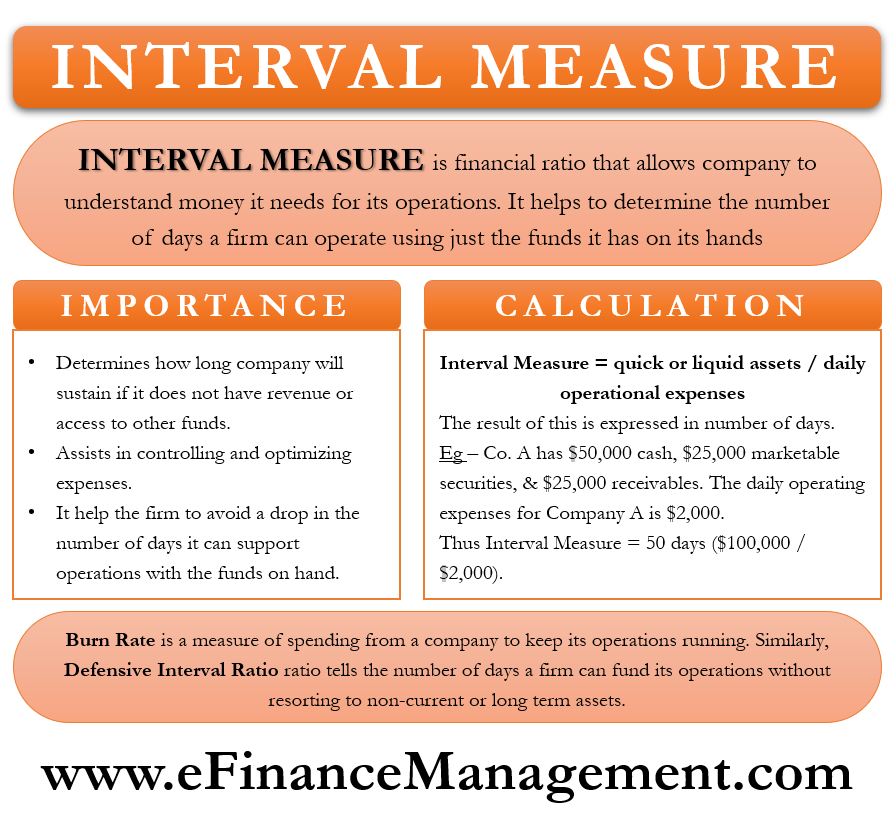

Interval Measure Meaning Importance How To Calculate Burn Rate Efm

The Cash Gap How Big Is Your Gap Cfo Simplified

Cash Flow Statement Examples And Analysis

Net Cash Flow An Overview Sciencedirect Topics

Cash Flow Ratios Calculator Double Entry Bookkeeping

What Is The Current Portion Of Long Term Debt Bdc Ca

Change In Working Capital Video Tutorial W Excel Download

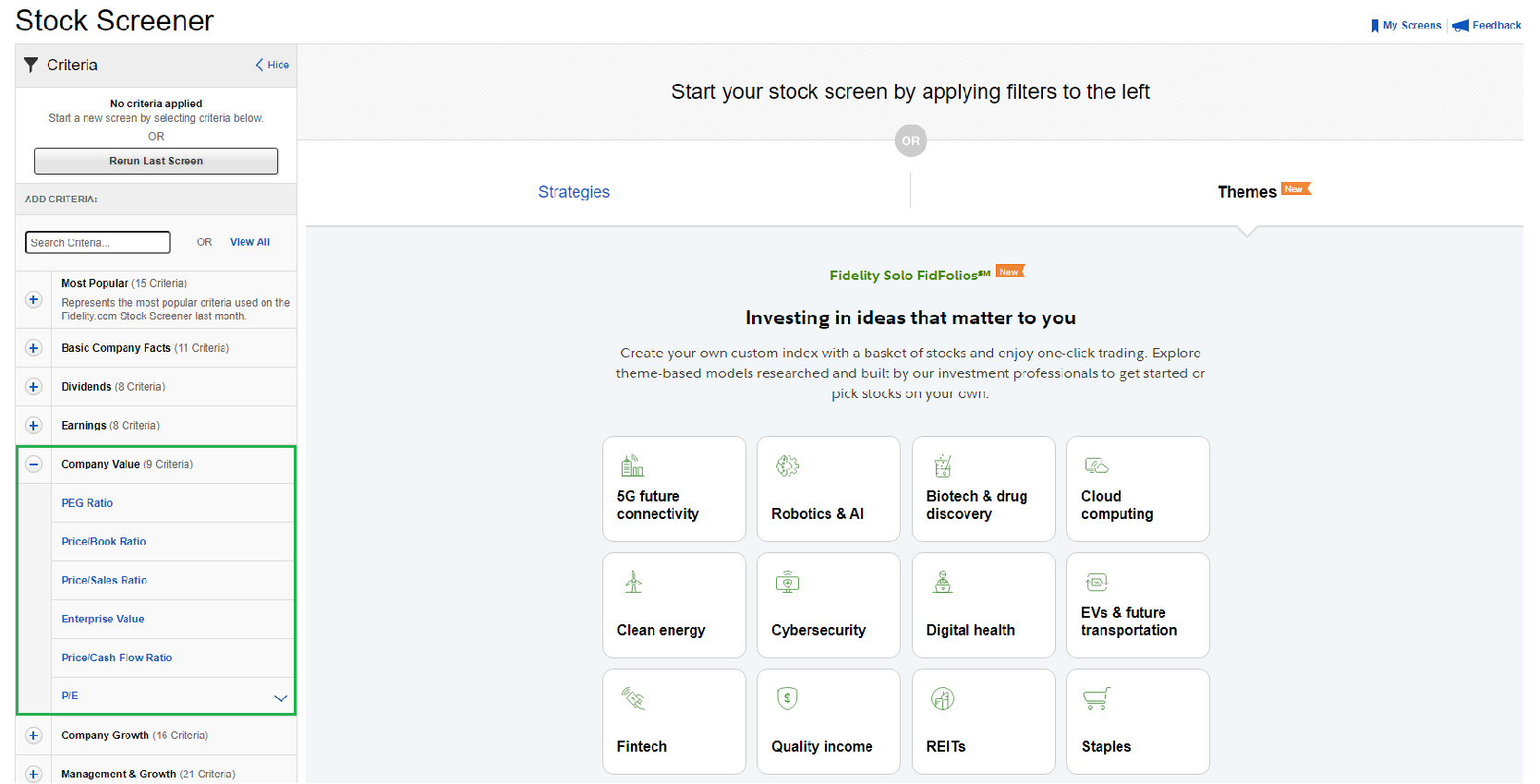

Company Valuation Ratios Fidelity

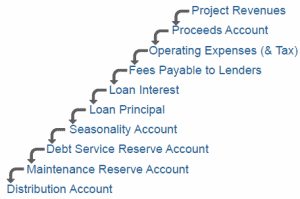

Cfads Cash Flow Available For Debt Service Mazars Financial Modelling

Project Finance Cash Flow Waterfall

Cash Flow Adequacy Financial Edge